tax on venmo cash app

If youve previously accepted payments and have earned taxable income through Venmo PayPal and other cash apps youve paid taxes on these funds in prior tax years. New Cash App Tax Reporting for Payments 600 or more.

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

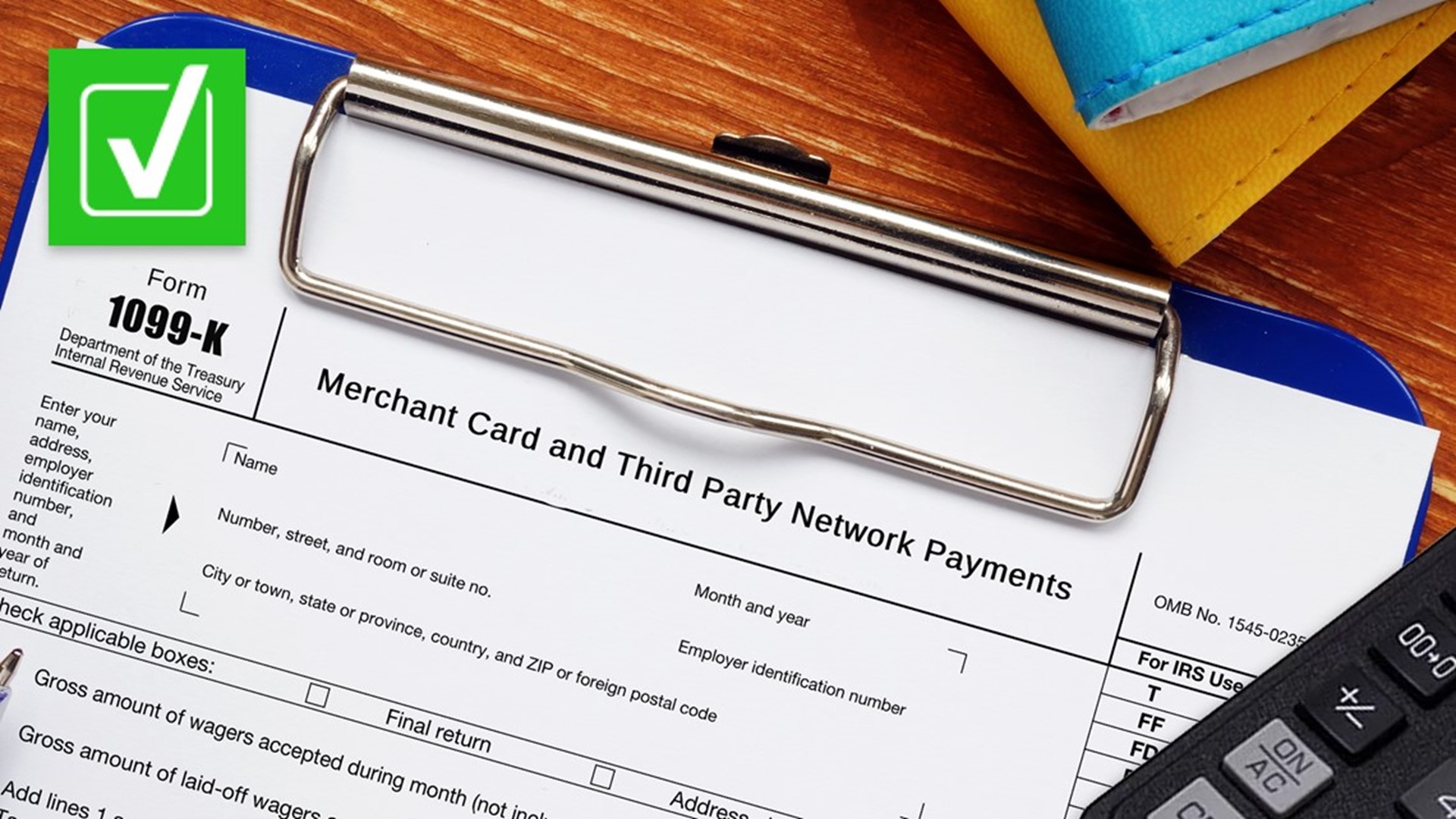

Yes users of cash apps will get a 1099 form if annual payments are over 600 but that doesnt mean extra taxes.

. Churches and ministries everywhere regularly use apps like Venmo Paypal and Cash App to easily receive charitable funds from their donors and members. Third-party payment processors like Venmo PayPal and Cash App are now required to report a users business transaction to the IRS if they exceed 600 for the year. The change begins with transactions starting January 2022 so it doesnt impact 2021 taxes.

According to FOX Business. Cash App Taxes formerly Credit Karma Tax is a fast easy 100 free way to file your federal and state taxes. 4 that it will send 1099s just to users enrolled in its Cash App for Business program.

New tax rule requires PayPal Venmo Cash App to report annual business payments exceeding 600. Theres a lot of misinformation surrounding new IRS cash app rules that went into effect January 1 2022 and many users worry their transactions on apps like PayPal Zelle Cash App or Venmo will be taxed. Theres a lot of chatter online about a new tax reporting requirement that applies to users of third-party payment processers like Venmo PayPal Zelle and Cash App.

This is probably most important for large transactions like splitting a beach vacation rental or something similar. Previously those business transactions were only reported. You wont have to automatically pay taxes on all the money you received through Venmo or the Cash App but this does increase the importance of putting in useful notes on transactions.

Millions of people have trusted our service to file their taxes for free and customers rated it 48 out of 5 stars. Venmo CashApp and other third-party apps to report payments of 600 or more to the IRS. January 19 2022.

Its not a new tax but the IRS is looking closely at transactions that are 600 or more. PayPal Venmo and Cash App to report commercial transactions over 600 to IRS Americans for Tax Reform President Grover Norquist discusses the impact of third-party payment processor apps. The new rule which.

And for many people in 2023 life will bring a 1099-K form to ensure certain transactions on apps like PayPal Venmo and Cash App are taxed appropriately. Rather small business owners independent contractors and those with a. To be clear this new regulation does not add a new tax.

Updated 349 PM ET Tue November 9 2021. Under the prior law the IRS required payment. Under the American Rescue Plan changes were made to Form 1099-K reporting requirements for third-party payment networks like Venmo and Cash App that process creditdebit card payments or electronic payment transfers.

1 if a person collects more than 600 in business transactions through cash apps like Venmo then the user must report that income to the IRS. Social media posts like this tweet that was published on September 15 have claimed that starting January 2022 if you receive more than 600 per year through. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

On it the company notes this new 600 reporting requirement does not apply to personal Cash App. The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Updated 316 PM ET Mon January 31 2022.

If youre among the millions of people who use payment apps like PayPal Venmo Square and other third-party electronic. The American Rescue Plan Act passed in March requires cash apps like Venmo PayPal and Zelle to report commercial transactions over 600. Starting in 2022 a new tax law went into.

CNN If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your transactions. A new tax law went into effect that requires third-party payment processors to report business transactions that meet certain new thresholds to the IRS. Exit Full Screen.

The IRS is not requiring individuals to report or pay taxes on individual Venmo Cash App or PayPal transactions over 600. Congress updated the rules in the American Rescue Plan Act of 2021. 1 mobile money apps like Venmo PayPal and Cash App must report annual commercial transactions of 600 or more to the Internal Revenue Service.

Media outlets have been debunking claims that theres a. Squares Cash App includes a partially updated page for users with Cash App for Business accounts. If you use payment apps like Venmo PayPal or CashApp the new year ushered in a change to an IRS tax reporting rule that could apply to some of your.

Life doesnt always give you lemons sometimes it gives you a Lego to step on or a chocolate chip cookie thats brimming with raisins. Cash App for example tweeted on Feb. Under the American Rescue Plan a provision went into effect at the beginning of this year that directs third-party payment processers to report transactions received for goods or services totaling over.

This is due to the new tax reporting requirement put on third. The new rule only applies to payments received for goods and services transactions meaning that. Heres who will have to pay taxes on.

You will pay taxes on any portion of funds considered taxable income. By Jeanne Sahadi CNN Business.

Tax Changes Coming For Cash App Transactions

Nowthis If You Are Doing Business With Your Clients Using Third Party Apps Like Cash App Paypal Venmo Or Zelle You Should Know That The Irs Will Soon Require Businesses To Report

Cash App Vs Venmo How They Compare Gobankingrates

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Paypal Venmo And Cashapp Will Report Taxes Exceeding 600 To Irs As Biden Government Passed The Law

Does The Irs Want To Tax Your Venmo Not Exactly

Advice On Venmo Having To Submit Sums Over 600 To The Irs R Personalfinance

How To Stop Your Teenager Being Charged By The Irs For Sending Money To Their Friends On Venmo And Paypal

What Cash App Users Need To Know About New Tax Form Proposals 9news Com

New Tax Law Irs Wants To Tax Cash App Venmo Zelle Transactions Small Business Princedonnell Youtube

Tax Law Changes Could Affect Paypal Venmo And Cash App Users

Income Reporting How To Avoid Undue Taxes While Using Cash App Gobankingrates

Venmo Cash App Can Be Risky Warns Consumer Group

/images/2022/02/08/cash-app-and-venmo.jpg)

What Venmo And Cash App Users Need To Know About New Tax Rules Financebuzz

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Here Are The Tax Changes Coming To Venmo Cash App Paypal And Other Apps Forbes Advisor

New Tax Laws 2022 Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You 6abc Philadelphia

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You News Wsiltv Com

Getting Paid On Venmo Or Cash App This New Tax Rule Might Apply To You